The latest NatWest Cymru Regional Growth Tracker showed signs of stability emerging in the private sector as the country entered the final quarter of 2025.

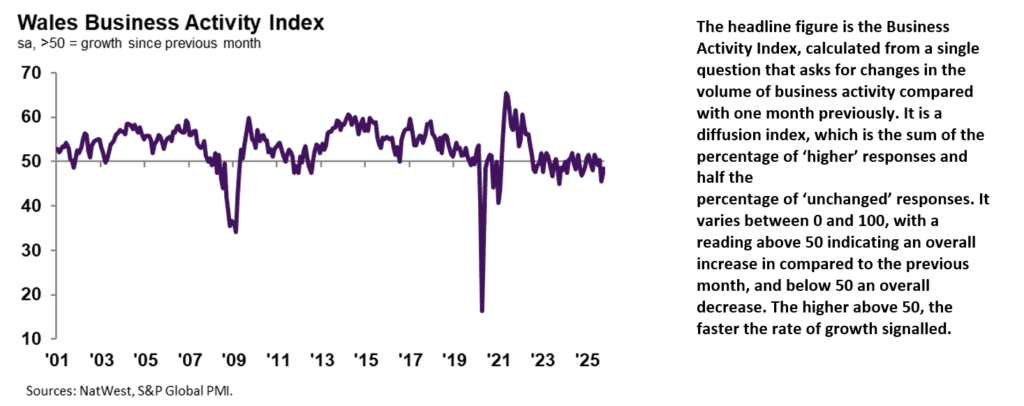

The headline Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – posted at 48.5 in October, up from 45.5 in September, and signalled a much slower contraction in output at Welsh companies.

Following a challenging 2025 for employment across Wales, October figures offered some reasons for optimism with the rate of job shedding at its slowest in 14 months. Similarly, some panellists reported an increase in the employment of and hiring intentions for temporary and unskilled workers.

Such intentions were echoed by confidence across the private sector that there will be a rise in output over the forthcoming year.

Jessica Shipman, Chair, NatWest Cymru Regional Board, said:

“Welsh businesses entered the final quarter of 2025 with emerging signs of improving demand conditions and a positive outlook for the year ahead.

“Following a challenging September, October’s Growth Tracker offered some examples of moves towards stability, with reports of easing cost pressures and softening margins, alongside some reports of active employment of temporary and unskilled workers. This shift also coincided with the slowest rate of job shedding across all sectors in the region in 14 months.

“Panellists also reported that they were confident of increasing activity for the year ahead, potentially buoyed by a softer fall in new orders following the sharp downturns experienced in September.

“Nonetheless, there is still reason to be cautious, with a slight slip in optimism compared to confidence seen in the third quarter.”

Performance in relation to UK

Although indicating a less marked decline in activity in October, the fall in output at Welsh firms was the strongest of the 12 monitored UK areas as demand conditions remained historically muted.

Welsh companies signalled a fourth successive monthly decline in new orders in October. The latest fall was only modest, however, and slowed notably from September. Similar to the trend for output, Welsh businesses registered the fastest contraction in new sales of the 12 monitored UK areas.

October data indicated a further rise in input prices at Welsh private sector firms. The pace of increase was in line with the long-run series average, as firms highlighted greater wage and material costs. Nonetheless, the rate of inflation cooled to the slowest in 11 months. Moreover, the pace of increase was slightly softer than the UK trend.

Welsh businesses continued to raise their selling prices in October. However, the pace of charge inflation was unchanged on the month and historically subdued. Companies reported that efforts to stay competitive and meet customer demands weighed on their pricing power. Of the 12 monitored UK areas, Welsh firms recorded the joint-weakest rise in output prices, alongside the East Midlands.

Muted demand conditions weighed on business confidence in the Welsh private sector, as the degree of positive sentiment in the year-ahead outlook for output slipped to the lowest since June. Of the 12 monitored UK areas, lower levels of optimism were seen in Scotland and Northern Ireland.

Workforce numbers at Welsh firms fell again in October, as has been the case for over a year. Higher wage bills and lower new orders continued to drive job losses, according to panellists, but some also noted the hiring of temporary or unskilled staff. The rate of decrease in employment was the weakest in the aforementioned sequence of decline. At the UK level, only the West Midlands recorded a sharper drop in workforce numbers, however.

At the same time, the pace of backlog depletion softened at the start of the fourth quarter. Moreover, the rate of decline was the sharpest of the 12 monitored UK areas.