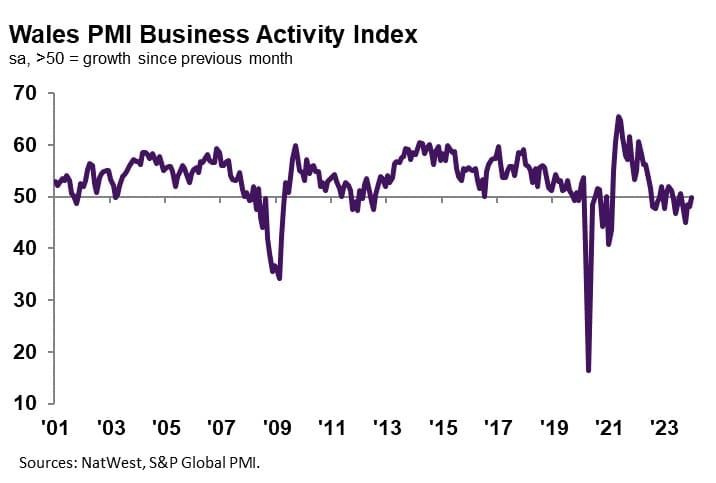

The headline NatWest Wales PMI® Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – rose from 48.0 in December to 49.9 in January, to signal broadly unchanged output levels at Welsh businesses at the start of 2024. The broad stabilisation in activity followed four successive monthly declines. Nonetheless, of the 12 monitored UK areas, only Wales and the North East posted a sub-50.0 reading. Where a decrease in activity was noted, Welsh companies linked this to further subdued demand conditions and a downturn in new orders.

Welsh private sector firms recorded an eighth successive monthly decline in new orders during January. Anecdotal evidence suggested the fall was due to subdued client demand and greater competition. That said, the rate of decline eased for the third month running to the slowest since last September.

The marginal drop in new orders contrasted with the UK trend which signalled a modest expansion.

Firms in Wales indicated strongly upbeat expectations regarding the outlook for output over the coming year in January. Greater optimism was attributed to planned investment in capacity expansion, new product launches and hopes of a pick-up in customer demand.

Although higher than the series average, the level of positive sentiment dipped from that seen in December and was lower than the UK trend.

Workforce numbers at Welsh firms dropped for the sixth month running in January, with companies cutting staffing levels at a steep pace. Although the slowest for three months, the rate of job shedding was sharper than the series average and contrasted with the UK trend. Moreover, the pace of decline was the quickest of the 12 monitored UK areas.

Lower employment was linked to the non-replacement of voluntary leavers and efforts to cut costs.

Welsh firms recorded a further drop in backlogs of work during January, thereby extending the current sequence of decline seen since May 2022. Panellists often noted that subdued demand conditions led to the sustained decrease in incomplete business.

Although the pace of contraction slowed to the weakest since April 2023, it was sharper than the UK average.

January data signalled a continued increase in input prices faced by Welsh firms. Manufacturers and service providers alike recorded an uptick in cost burdens, as the overall rate of inflation quickened to the fastest since May 2023. Higher input prices were linked to greater wage bills, alongside increased supplier and transportation costs.

Despite accelerating, the pace of increase was slower than both the UK and historic series averages.

Welsh businesses registered a further solid rise in selling prices at the start of the year. The pace of inflation was little changed from that seen in December and slightly quicker than the long-run series average. The uptick in output prices reportedly stemmed from the pass-through of greater costs to customers.

The rate of increase was among the slowest of the 12 monitored UK areas, however, and faster than only Northern Ireland, the North West and Yorkshire & Humber.

Jessica Shipman, Chair, NatWest Cymru Regional Board, commented:

“The start of 2024 signalled more positive trends emerging from the Welsh private sector, as activity was broadly stable on the month and the contraction in new business slowed to only a marginal rate. Firms also remained strongly upbeat in their expectations for the year ahead, and future expansion in output.

“Nonetheless, businesses cut workforce numbers steeply as pressure on capacity dwindled further. Job shedding in Wales was the fastest of the 12 monitored UK areas, with firms looking to rein in costs and have a tighter control on spending.

“Although cost burdens rose at a marked and accelerated pace, the rate of inflation was below both the historic series and UK averages. Moreover, in a bid to secure new sales, companies raised selling prices at only a solid rate that was among the weakest across the UK and much slower than that seen over 2023 as a whole.”