New car registrations collapsed to a 24-year low last month, despite bulging orders which car-makers cannot supply.

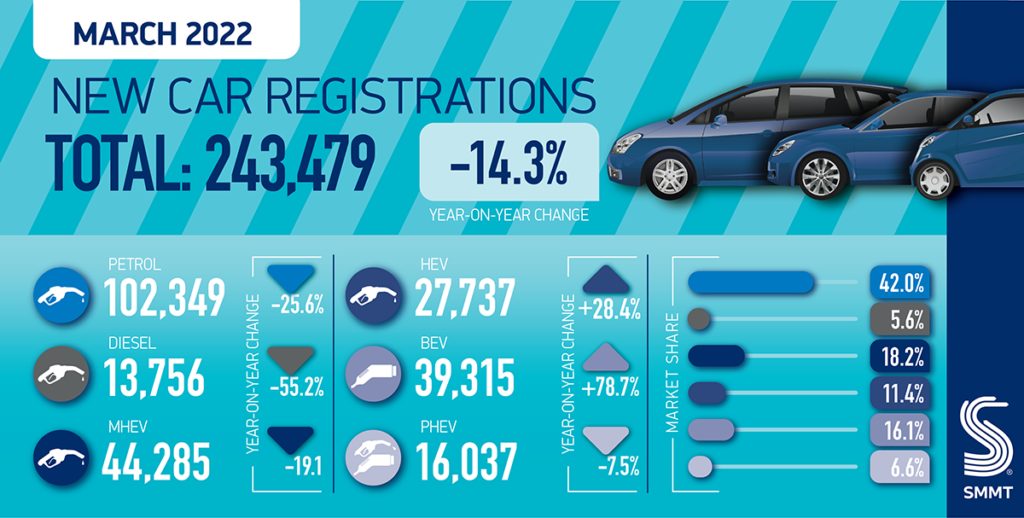

UK new car registrations fell by -14.3% to 243,479 units in March, according to the latest figures from the Society of Motor Manufacturers and Traders.

Wales bucked the trend and saw 9,523 new cars registered with the new 71-plate in March, a 2.52% rise on the same time last year and the only part of Britain to record any improvement.

The statistics also showed pure battery cars registrations soared 78.7% in the month compared to 12 months ago and reached 39,315 cars, together with electrically assisted cars they took about a third of the months sales. Diesels continue to drop, now down over 55% to just 13,736, although petrol still accounts for most sales at 102,349.

Despite manufacturers reporting robust order books during the first quarter, ongoing supply chain shortages – especially of semiconductors – continued to squeeze supply during what is normally the industry’s busiest month as buyers demand the latest numberplate.

This is, therefore, the weakest March since 1998, which was prior to the introduction of the two-plate system. Given around 20% of total annual registrations are usually recorded in March, the result is massively disappointing for the sector and underscores the long-term impact the pandemic is wreaking on the industry.

In spite of the rollback of pandemic restrictions, which limited the industry to ‘click and collect’ in the first part of 2021, overall Q1 registrations for 2022 were down -1.9%.

While private registrations grew by 8.2% in the month, March 2021 had seen showrooms closed due to social distancing regulations. Large fleet registrations, meanwhile, declined by -34.4% but business registrations grew by 20.0% as manufacturers prioritised private consumer and smaller business orders.

There were some very interesting trends emerging however. Battery electric vehicles (BEVs) continued to enjoy tremendous growth, with 39,315 new zero emission cars leaving dealerships – an increase of 78.7% on last year – and taking a 16.1% market share.

This is the highest volume of BEV registrations ever recorded in a single month, and means that more were registered in March 2022 than during the entirety of 2019.Plug-in hybrid (PHEVs) registrations declined by -7.5% to 16,037 units, but hybrids (HEVs) grew 28.4% to 27,737 units. As a result, electrified vehicles comprised more than a third (34.1%) of all new car registrations.

With the industry reporting strong order books, it is the constraints on supply that are preventing the sector from moving into full recovery.

The shortage of semiconductors, itself an effect of the pandemic, is affecting the sector globally but longer-term uncertainty remains, with the invasion of Ukraine raising risk to supply chains.

More broadly, however, economic headwinds such as rising energy costs, fuel costs, inflation and a squeeze on household incomes could impact new vehicle demand. With grants for BEVs ongoing until at least next March, however, interest rates still low and electric cars benefiting from lower running costs, there are significant benefits for drivers who can order new vehicles now.

Mike Hawes, SMMT Chief Executive, said,“March is typically the biggest month of the year for the new car market, so this performance is deeply disappointing and lays bare the challenges ahead.

“While demand remains robust, this decline illustrates the severity of the global semiconductor shortage, as manufacturers strive to deliver the latest, lowest emission vehicles to eagerly awaiting customers.”

In a landmark result, Ford and Kia tied with 7.32% market share as Ford sales slipped 19.8% from the same month in 2021 while the Korean car maker enjoyed a 58.81% rise in registrations, with Toyota in third place having 6.62%, slightly down on 2021’s figure.

The big winners were those who sold BEV or hybrid electric cars in their ranges with Tesla seemingly coming from nowhere to take the top two spots with the Y and 3 series models.

Exclusively electric Polestar, part of the Volvo empire of Geely, posted a 135.52% improvement with just 789 cars delivered in March, still just 0.32% of sales, although MG was the most improved with 9,367 registrations, some 3.85% a jump of 136.78%.

March UK top ten

- Tesla Model Y

- Tesla Model 3

- Vauxhall Corsa

- Nissan Qashqai

- Hyundai Tucson

- Ford Puma

- Kia Sportage

- Ford Kuga

- Toyota C-HR

- Ford Fiesta

New light commercial vehicle (LCV) registrations fall by -27.6% in March to 40,613 units.

Registrations of large vans down -18.9%, while demand for medium-sized vans, the second biggest segment by volume, falls -27.6%.

Market ends first quarter of 2022 at -27.6% below pre-pandemic levels, as global shortage of semiconductors continues to affect supply.