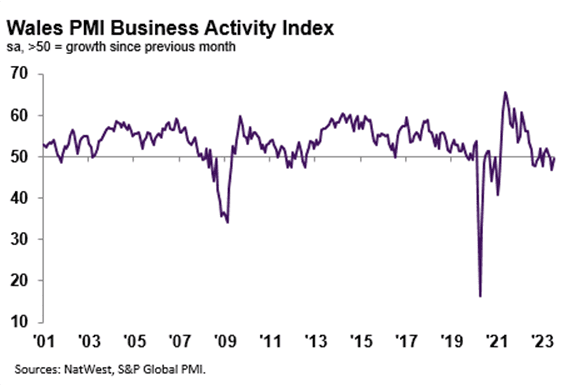

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 49.5 in July, up from 46.7 in June, to signal a further, but slower fall in output at Welsh firms. The latest decline extended the current sequence of contraction to three months, but was the weakest in this period. Where a decrease in business activity was noted, firms linked this to muted demand conditions and a drop in new orders. The slight downturn contrasted with a marginal expansion seen at the UK level.

July data signalled a sharper decrease in new orders at Welsh firms, with the pace of decline accelerating to the steepest since October 2022. The fall in new business was linked to weaker demand conditions and the impact of high interest rates and the greater cost of living.

Of the 12 monitored UK areas, Welsh firms registered the quickest contraction in new orders. Manufacturers saw little change in new orders, but service providers recorded a faster decrease in new business.

Welsh private sector firms remained upbeat regarding the outlook for output over the coming year at the start of the third quarter. Confidence was reportedly due to hopes of greater client demand and investment in new staff. Although the degree of optimism was above the series average, it dropped to the lowest since January and was weaker than the UK trend.

July data indicated a marginal expansion in workforce numbers at Welsh firms. The rise was the first increase in employment in 2023 so far and the sharpest since October 2022. The rate of job creation was broadly in line with the UK average, as Welsh service providers drove the upturn.

Firms stated that greater employment stemmed from efforts to fill long-held vacancies.

Welsh firms registered a fifteenth successive monthly decrease in backlogs of work during July, with the pace of contraction little-changed from that seen in the previous survey period. Companies continued to note that the ability to complete unfinished business was due to weak client demand and another decline in new orders.

The rate of decline far exceeded that seen at the UK level.

Welsh firms recorded a marked rise in average cost burdens at the start of the third quarter. The rate of inflation quickened from that seen in June, but was nonetheless the second-slowest since November 2020. The pace of increase was far weaker than the UK average, with only Northern Ireland registering a softer uptick in operating expenses.

Service providers drove the increase in costs, with manufacturers seeing a decrease in input prices amid reports of lower transportation and material costs.

July data indicated a further rise in output charges at Welsh private sector firms. The rate of increase was solid overall and slightly faster than the long-run series average. Nonetheless, the pace of inflation slowed for the third month running and was the softest since February 2021.

Of the 12 monitored UK areas, only Northern Ireland recorded a slower rise in output charges.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Welsh firms faced a difficult start to the second half of the year, as output remained in contraction and new orders fell at a sharper rate. Weak demand conditions and pressure on customer purchasing power from the rising cost of living and higher borrowing costs weighed on overall sales.

“Nonetheless, firms were optimistic regarding the future outlook, as employment returned to growth. The filling of long-held vacancies supported another marked decline in outstanding business.

“Meanwhile, inflationary pressures remained well below the levels seen throughout 2021 and 2022. Although input costs rose at a slightly faster pace, the rate of inflation stayed softer than the long-run average as some raw material costs were reported to have fallen. That said, efforts to stimulate demand put strain on margins and reduced pricing power at firms.”