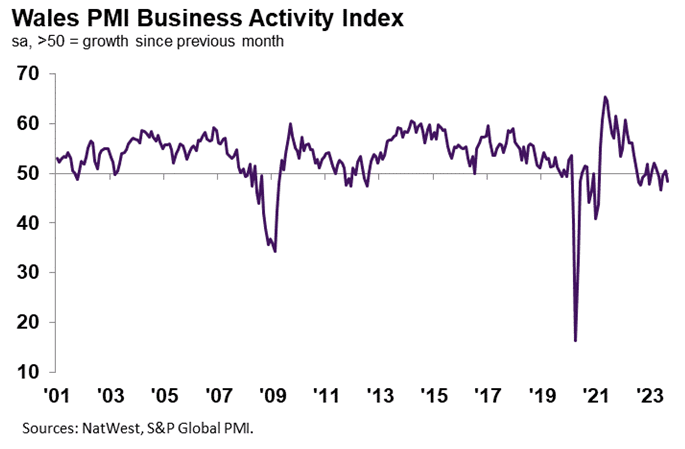

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 48.4 in September, down from 50.5 in August, to signal a renewed and marginal decline in business activity at Welsh firms. The pace of contraction was the fastest since June, but broadly in line with the average seen across the UK as a whole. Anecdotal evidence suggested that lower output was due to weak client demand and a faster reduction in new orders.

Private sector firms in Wales registered a fourth successive monthly decline in new orders during September. The rate of contraction was only marginal overall, but quickened from August. Lower new business was linked to subdued client demand, with some companies reporting order postponements and deferrals.

Manufacturers recorded a renewed fall in new orders, while service providers registered a sharper drop in customer demand.

Welsh private sector firms registered positive expectations regarding the outlook for output over the coming year in September. That said, the degree of confidence dropped to the lowest in almost a year and was well below the UK average. Although firms were hopeful that new product launches and an uptick in client demand would support growth in activity, higher selling prices and business costs continued to weigh on projections for both output and client purchasing power.

Employment at Welsh private sector firms decreased for the second successive month in September. The rate of contraction accelerated to the joint-sharpest since January 2021 and was quicker than the UK average. Moreover, only the North East and East Midlands recorded faster declines in workforce numbers.

Lower staffing numbers were often linked to reduced new orders and the non-replacement of voluntary leavers.

Welsh private sector firms recorded a further marked decrease in the level of outstanding business at the end of the third quarter. The decline in backlogs of work eased slightly from August’s recent low, but was the second-fastest since May 2020. Of the 12 monitored UK areas, Welsh firms registered the steepest fall in incomplete business amid lower new order inflows.

At the sub-sector level, goods producers and service providers alike saw substantial declines in unfinished work.

Average cost burdens across the Welsh private sector increased at a further sharp pace during September. That said, the pace of inflation slowed to the weakest since October 2020 and was softer than the series average. Moreover, Welsh firms registered one of the slowest upticks in business expenses of the 12 monitored UK areas.

Although higher input costs were reportedly driven by greater wage bills and increased fuel prices, some companies mentioned that reduced material costs had dampened inflation.

Output charges at Welsh firms increased at a solid pace in September, but the rate of inflation eased to the slowest since January 2021. The pace of increase was also softer than both the long-run series and UK average. Firms noted that they continued to try to pass higher costs through to customers, but that increased competition for orders pushed them to only moderate upticks in selling prices.

At the sub-sector level, manufacturers saw a decrease in output charges, while service providers recorded a solid increase.

Jessica Shipman, Chair, NatWest Cymru Regional Board, commented:

“Welsh firms signalled a return to contraction in output during September, as new orders fell at a faster pace. Weak demand and the ongoing impact of the cost-of-living crisis on customer spending patterns weighed on new sales. In turn, firms scaled back their hiring at the joint-quickest rate since January 2021, as business confidence slipped to an 11-month low.

“Subdued demand for inputs and greater competition for orders led to a welcome softening of inflationary pressures. Input costs and output charges rose at paces below their respective series average, as savings on material prices were passed through to customers in an effort to drive sales.”