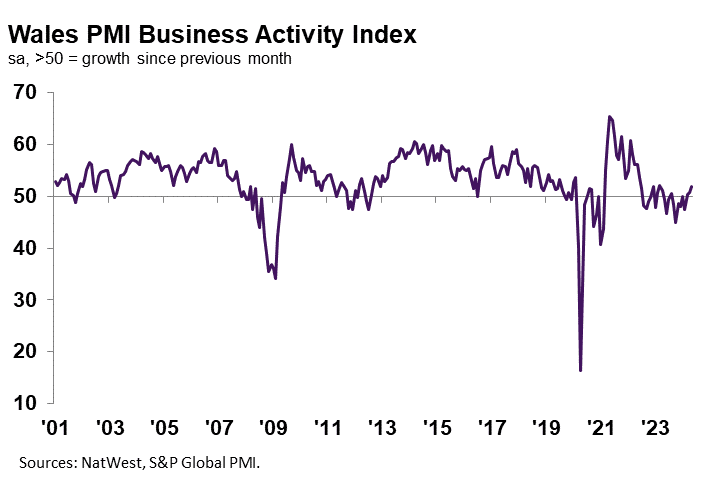

The headline NatWest Wales PMI® Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – posted at 52.0 in May, up from 50.8 in April, to signal the sharpest rise in output at Welsh private sector firms since March 2023. Although slower than the series average, the latest increase in activity was supported by a further improvement in demand conditions and a sustained uptick in new orders. The expansion was among the weakest seen of the 12 monitored UK regions and nations, however, with only Yorkshire & Humber, the South East and East of England recording softer growth in output.

Private sector firms in Wales signalled a third successive monthly expansion in new orders midway through the second quarter. Panellists noted that demand conditions were sustained, alongside new client wins. The rate of growth eased, however, to the slowest in the aforementioned sequence and was only marginal overall. Meanwhile, the pace of increase in new business was weaker than the UK average.

Welsh businesses registered further optimism regarding the outlook for output over the coming 12 months in May. The degree of confidence ticked up to a three-month high, but was also among the strongest in two-and-a-half years. Anecdotal evidence attributed positive sentiment to hopes of more upbeat demand conditions and efforts to broaden customer bases.

Expectations were historically elevated and more optimistic than that seen at the UK level.

May data signalled a third successive monthly increase in employment at Welsh private sector firms. The rate of job creation accelerated to a modest pace that was the fastest since October 2022. Companies stated that greater staffing numbers were due to increased new order intakes.

The rate of expansion in headcounts was historically upbeat and outpaced the UK average.

As has been the case since May 2022, Welsh firms registered another monthly decrease in unfinished business midway through the second quarter. The pace of decline accelerated to the fastest in three months and was sharp overall. Companies noted that an improvement in supply chains and sufficient capacity allowed them to work through incomplete orders in a timely manner.

Moreover, Welsh firms by far saw the quickest decrease in backlogs of work of the 12 monitored UK regions and nations.

Welsh private sector firms signalled a marked rise in input prices during May. Panellists often stated that greater cost burdens stemmed from increased raw material and fuel prices, alongside higher wage bills. The pace of cost inflation softened from April’s recent high and was broadly in line with the long-run series average.

Meanwhile, Welsh firms indicated a sharper uptick in costs than was seen at the UK level.

Selling prices set by Welsh private sector firms continued to increase at a historically elevated pace in May. Anecdotal evidence suggested that firms sought to pass-through higher costs to customers. The pace of inflation eased to the slowest in four months, however, and was broadly in line with the UK average.

Jessica Shipman, Chair, NatWest Cymru Regional Board, commented:

“Welsh businesses signalled stronger output growth in May, as sustained demand conditions and a further rise in new order intakes supported the faster expansion in activity. Moreover, buoyed by a relatively upbeat sales environment compared to recent months and greater optimism in the year-ahead outlook, companies sought to expand capacity and hired additional staff at the quickest pace since October 2022.

“Meanwhile, inflationary pressures remained elevated but softened from April. In a bid to boost new sales, selling prices rose at the slowest pace in four months. Nonetheless, the rate of charge inflation was above the series average, suggesting customer demand may not gain significant momentum in upcoming months as client purchasing power remains under pressure.”