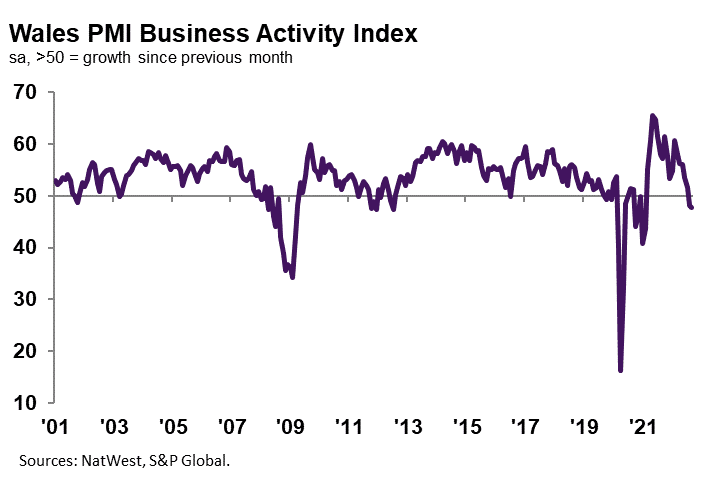

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 47.7 in September, down from 48.1 in August to signal a modest contraction in output across the Welsh private sector. The pace of decline was quicker than the UK average and the fastest seen in Wales since February 2021. Lower business activity was often linked to supply chain issues and weak client demand. The drop in output was broad based, with manufacturers recording a slightly sharper downturn.

New business across the Welsh private sector continued to decline during September. The rate of contraction quickened to a strong rate that was the sharpest since the start of 2021. The fall was also faster than the UK average. Anecdotal evidence suggested that lower new order inflows stemmed from weak client demand and a reduction in new enquiries.

At the sector level, service providers registered a sharper fall than their manufacturing counterparts.

September data signalled further muted expectations regarding the outlook for output over the coming 12 months at Welsh private sector firms. Although the degree of confidence picked up from August’s recent low, it was among the weakest since March 2020. Planned investment in new product and services, alongside hopes of stability in supply chains supported optimism. That said, ongoing concerns regarding inflation and economic conditions weighed on sentiment.

Welsh private sector firms recorded a further upturn in employment at the end of the third quarter. The rise in workforce numbers was linked to the filling of long-held vacancies. The rate of job creation eased to a solid pace that was the slowest in 2022 to-date. The pace of increase was broadly in line with the UK average.

The level of work-in-hand decreased further during September, thereby extending the current sequence of decline to five months. The drop in outstanding business was attributed to lower incoming new work. The rate of contraction slowed but was the second-fastest since February 2021.

Manufacturers recorded a faster fall in backlogs of work than service providers.

Average cost burdens faced by Welsh private sector companies increased further in September. The rate of cost inflation quickened to the fastest for three months and was marked overall. Higher input costs stemmed from greater energy, material and fuel prices, with a weak pound compounding price hikes.

The rate of increase at Welsh firms was the sharpest of the 12 monitored UK areas.

Output charges at Welsh private sector firms increased at a marked pace again in September. The rate of inflation was broadly in line with that seen in August and the fastest of the 12 monitored UK areas. Higher output charges were linked to the pass-through of greater cost burdens to customers. The pace of increase was softer than earlier in the year, however, as firms noted increased competition and reduced purchasing power at clients.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“September data signalled ongoing challenges for Welsh manufacturers and service providers, as client demand weakened further and output fell. Strain on customer purchasing power worsened amid hikes in inflation and energy costs, with new orders falling at the fastest pace since the start of 2021. As a result, backlogs of work decreased solidly and employment growth slowed for the third month running.

“Meanwhile, cost pressures mounted further. Input prices rose at the quickest rate since June as a weak pound heightened imported inflationary pressures. Despite a faster fall in new orders, Welsh firms hiked their selling prices markedly again, and at the sharpest pace of the 12 monitored UK areas.”