Tips for Getting a Personal Loan with Poor Credit

Having poor credit can prevent you from getting the best rates on a personal loan. Borrowers with low credit can’t always qualify for flexible lending terms and conditions. Also, it can be harder to get insurance and even find high-paid jobs if your rating is less-than-stellar. Keep on reading to find out how to obtain bad credit loans and solve your temporary financial disruptions.

Steps to Get Personal Loans for Bad Credit Holders

1. Check Your Credit

Every crediting institution has a minimum credit rating demand for borrowers. So, if you want to apply for personal loans with bad credit, you should first check your credit. You can order your free credit report from one of the major credit reporting agencies. It is free of charge if you order it once a year.

This is a great solution for getting a detailed overview of your credit behavior for the past years. It is also beneficial as some borrowers may find errors on their reports that may be the reason for low credit.

2. Compare Several Creditors

Every lender may offer different terms and interest rates so if you take some time to compare several service providers. You may get different quotes from various lenders. Some of them offer credit-builder loans with bad credit as well. Moreover, other sites like Credit Karma have more affordable options and lending conditions.

3. Pre-Qualify

When you have a chance to pre-qualify, you can receive the loan amount, repayment conditions, and the interest rate that you may get approved for. This process doesn’t harm your credit at all. You can utilize pre-qualification to compare lending offers and choose the most suitable solution.

4. Add a Co-Signer

Online loans for bad credit consumers can be harder to achieve if they don’t secure the loan or find a co-signer. If you aim to qualify for the lowest and most reasonable rates, you need to find a person who will become your co-signer.

This person should have a better rating as he or she will be responsible for the debt repayment in case of your default. Another solution is to apply for a secured loan. If you have collateral that can be used to back the loan up, you may want to try this option.

5. Apply for a Loan

Even poor credit consumers have a chance to resolve their financial issues by getting a special loan. If you collect all the necessary papers, find a co-signer, and pre-qualify, the process will be much faster. Some crediting offices may ask for your financial statements, pay stubs, W-2s, and other documents.

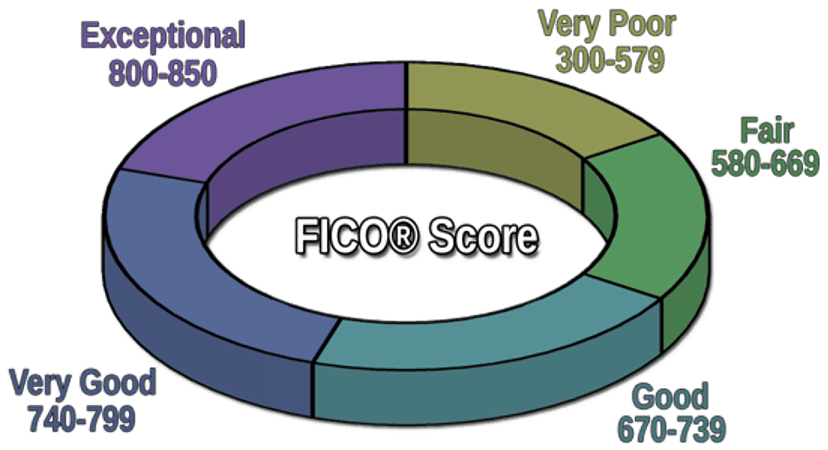

Important Facts About Credit Score

Your credit report and credit rating have a significant influence on your financial life. According to BadCredit.org, only 11% of American consumers have the lowest FICO ratings of 550 and less. Close to 20% of U.S. citizens have a subprime credit rating. Those who have very low credit scores usually face challenges connected with personal finance.

It can be much more challenging to qualify for extra financing. Even if the crediting institution approves the borrower’s application for a credit card or loans for bad credit, the interest rates will be much higher. On the other hand, it’s good that 89% of the consumers have credit above 550. Borrowers with scores in the 700s can generally qualify for more flexible terms and lower rates.

Calculate Your Payments

Your credit rating may seriously affect your ability to obtain a loan or a credit card. You need to understand the total interest costs and monthly payments before you submit your application. Some consumers apply without knowing the final sum they will have to pay off. On-time payments and reasonable rates can help you improve your credit.

Besides, traditional banks and credit unions usually conduct hard credit inquiries that can damage the credibility of the clients. You need to avoid hard credit pulls at maximum if your rating is less-than-stellar. Turn to alternative lenders and pre-qualify to preview the loan conditions or utilize a personal loan calculator to obtain an estimate.

How Poor Credit Affects Your Creditworthiness

Your credit defines your ability to get a loan or credit card. When a financial emergency hits you, not many people have enough time to think about their credit. If you have a history of missed or late payments in the past, it may affect your creditworthiness. A low credit tells a creditor how likely you are to repay the debt.

If you present high risks of default or non-payment, the lenders won’t be eager to deal with you. That’s why most conventional lenders deny the applications if they can’t guarantee their funds will be returned on time. Low credit can lead to the rejection of your application.

Those who don’t want to be denied should boost their chances by getting a secured loan or finding a co-signer. Do you have an auto or other valuable items that can be utilized as collateral? It can help you apply for a secured loan.

The Bottom Line

To sum up, borrowers may find themselves in a situation where their credit is less-than-perfect. However, an urgent money issue can’t wait so you need to apply for a credit card or a small loan. You may search for alternative crediting companies that can issue the funds to low credit holders. Otherwise, it may be a smart solution to take some time and repair your credit.

You may qualify for a credit-builder loan or find a person who will become your co-signer. Checking your credit and comparing several service providers can help you avoid mistakes and opt for the most suitable solution. Don’t hesitate to take some time to repair your credit by making regular payments according to the repayment schedule so that you qualify for lower rates in the future.