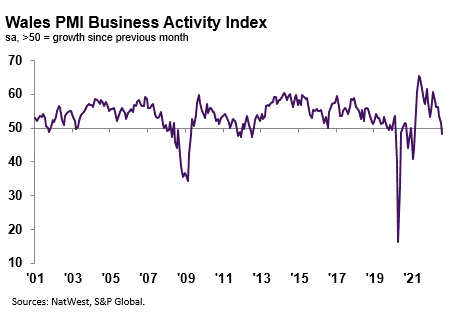

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 48.1 in August, down from 51.6 in July, to signal a renewed fall in output across the Welsh private sector. The decrease was the first in 18 months, albeit only modest overall. Companies stated that lower business activity stemmed from weak client demand and a decline in new order inflows. The rate of decrease in output was quicker than the UK average.

New orders received by Welsh private sector firms declined for the first time in a year-and-a-half in August. The rate of contraction was solid overall and quicker than the UK average. Lower new order inflows were reportedly due to weak client demand and reduced purchasing power at customers amid hikes in selling prices.

At the sub-sector level, manufacturers and service providers registered decreases in new business.

Welsh private sector firms recorded less upbeat output expectations regarding the year-ahead outlook midway through the third quarter. Although sentiment remained optimistic overall, the degree of confidence slipped to the lowest since the introduction of lockdown measures in March 2020. Despite hopes of supply chain stability, positive sentiment was weighed down by concerns of subdued client demand and surging costs.

August data signalled a further uptick in workforce numbers across the Welsh private sector. The rise in employment was attributed to efforts to expand capacity, with the rate of job creation broadly in line with the UK average. That said, the pace of job creation slowed to the joint-softest in 2022 to date, as some firms reported the non-replacement of voluntary leavers.

Private sector firms in Wales recorded a fourth successive monthly reduction in the level of outstanding business during August. The fall in backlogs of work was strong overall and the sharpest since November 2020. The decrease was steeper than the UK average, with firms attributing the decline to lower new order inflows which allowed them to work through incomplete business.

Private sector firms in Wales registered another marked monthly increase in input prices during August. The rise in cost burdens was among the sharpest on record, despite softening to the slowest since May 2021. Higher operating expenses were often attributed to hikes in energy, fuel, wage and material costs.

The rate of cost inflation seen at Welsh firms was among the steepest of the 12 monitored UK areas, slower than only Northern Ireland and the South East.

Average output charges for Welsh goods and services rose at an historically elevated pace midway through the third quarter. Greater output charges were commonly linked to the pass-through of higher costs to clients. The pace of output price inflation eased for the third month running, however, and was the slowest since September 2021.

Nonetheless, the rate of increase in selling prices was the joint-fastest of the 12 monitored UK areas, alongside the North East.

Kevin Morgan, NatWest Wales Regional Board, commented:

“Welsh private sector firms signalled a further loss of growth momentum in August, as output and new orders returned to contraction territory for the first time in a year-and-a-half. Weak demand conditions stemming from surging inflation and strain on customers’ disposable incomes led to a solid fall in new business. In response, output expectations slumped and firms looked to cut costs as employment grew at the joint-slowest pace this year.

“Prices remained historically elevated as energy, fuel and wage costs spurred on inflation. Welsh firms saw some of the sharpest hikes in costs and selling prices across the UK, despite rates of inflation easing again.”