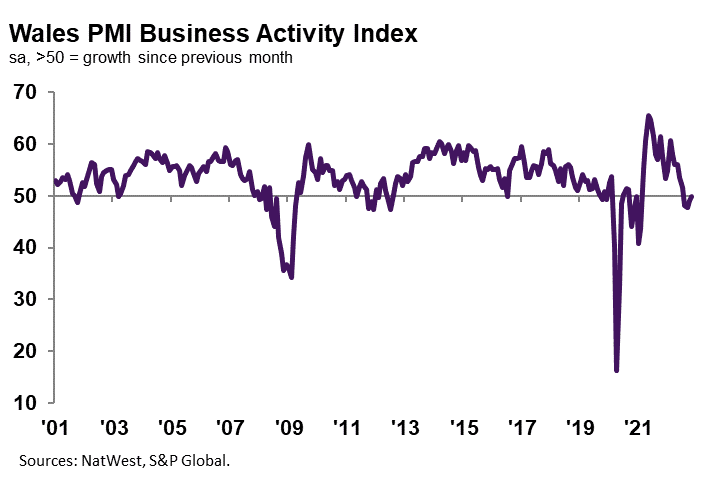

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 49.8 in November, up from 49.1 in October to signal broadly unchanged levels of output. The slower downturn was linked to a less marked contraction in new business during the month. Alongside firms in the North East, Welsh companies registered the joint-highest headline index reading, with the UK average indicating a modest decrease in business activity.

Welsh businesses recorded a fourth successive monthly decline in new orders during November. Where a decrease was noted, firms linked this to weak demand conditions and material shortages. That said, the rate of contraction slowed to the softest in the aforementioned sequence of decline and was only fractional overall. Alongside the North East, Welsh firms registered the slowest downturn of the 12 monitored UK areas.

November data signalled an improvement in business confidence across the Welsh private sector. The degree of optimism was historically muted, however, and the second-lowest since March 2020. Hopes of greater client demand buoyed expectations, but concerns regarding further reductions in new orders and hikes in cost burdens weighed on positive sentiment.

Welsh private sector firms registered only a fractional increase in workforce numbers midway through the fourth quarter. The rate of job creation was the slowest in the current 19-month sequence of employment growth. Firms stated that the slower upturn in staffing numbers was due to cost-cutting efforts and lower new business.

The rate of increase was weaker than the UK average.

Welsh private sector businesses indicated a further decrease in the level of outstanding work during November. Lower levels of incomplete business were attributed to a reduction in new orders. The fall in backlogs of work was marginal overall and slowed to the softest since June.

Welsh firms signalled a contrasting trend to the UK average, where backlogs of work were little-changed on the month.

Average cost burdens at Welsh private sector firms rose at a further substantial pace during November. Higher input prices were often linked to hikes in supplier, energy and transportation costs. Although marked, the rate of cost inflation eased to the slowest since May 2021 and was only slightly sharper than the UK trend.

At the sub-sector level, service providers signalled a faster rise in costs than their manufacturing counterparts.

November data signalled a continued rise in selling prices at Welsh private sector firms. The increase in output charges was marked overall, but eased to the slowest since August 2021. Although firms noted the further pass-through of higher costs to clients, some stated that charges were lowered in an effort to drive new sales.

Nonetheless, the rate of charge inflation in Wales was the sharpest of the 12 monitored UK areas.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Firms in the Welsh private sector signalled a moderation in contractions in output and new orders during November. Demand conditions remained subdued, but the pace of decline eased notably from October. Nonetheless, firms were cautious in their expectations for the future. Business confidence was historically muted, and employment rose at only a fractional pace that was the slowest in over a year-and-a-half of job creation.

“More encouragingly, however, were downwards adjustments to inflation figures as input prices and output charges increased at softer rates. Although still marked, hikes in cost burdens and selling prices were much slower than seen earlier in the year. Pressure on customer spending as disposable incomes dwindle remains a key concern for firms, however, as the cost-of-living crisis persists.”