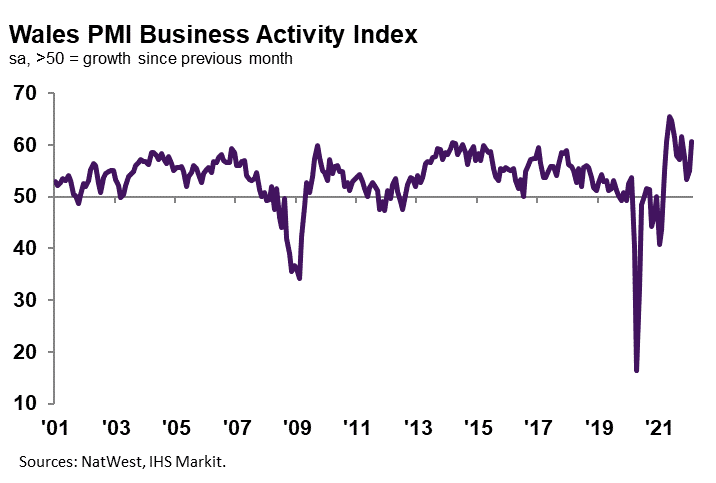

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 60.7 during February, up from 55.0 in January, to signal a marked expansion in private sector output. The rate of output growth was the fastest seen for four months and among the sharpest of the 12 monitored UK areas, slower than only London and Yorkshire & Humber. Firms noted that the uptick in activity stemmed from stronger client demand and a steeper rise in new business.

Welsh private sector firms signalled a quicker rise in new orders midway through the first quarter. The upturn was sharp overall and the fastest since last November. Companies stated that the expansion was due to greater demand from new and existing customers. The rate of growth was among the slowest of the 12 monitored UK areas, behind only Scotland and the North East.

February data indicated strongly upbeat expectations regarding the outlook for output over the coming year at Welsh firms. Survey respondents noted that greater optimism stemmed from hopes of a further uptick in client demand and investment in marketing and product development. Although the degree of confidence was strong overall, it was among the weakest of the 12 monitored UK areas.

Welsh private sector firms recorded a steep expansion in employment during February, and one that was the joint-fastest since September 2021. The sharp rise in workforce numbers was linked to greater new orders and increased business requirements. That said, the rate of job creation was slower than the UK average.

Backlogs of work across the Welsh private sector grew strongly in February, but at the slowest pace since April 2021. Although some firms stated that labour shortages hampered their ability to process incoming new business, others suggested that a reduction in supply-chain delays allowed work-in-hand to be completed.

Welsh private sector firms registered another substantial uptick in input prices midway through the first quarter. Survey respondents attributed higher cost burdens to increased material, energy and transportation bills. Although the rate of cost inflation softened slightly from January, it was among the fastest on record and quicker than the UK average.

Selling prices at Welsh private sector firms increased at a marked pace during February. The rate of charge inflation was unchanged from that seen in January and was the joint-softest since last September, despite being the second-fastest of the 12 monitored UK areas (slower than only Northern Ireland). Panellists commonly noted that higher output charges were linked to the pass-through of greater cost burdens to clients.

Kevin Morgan, NatWest Wales Regional Board, commented:

“The Welsh private sector signalled further output growth momentum in February, as the rate of expansion quickened to the fastest since October 2021. Greater business activity largely stemmed from stronger demand conditions, as new orders rose markedly.

“As a result, companies continued to hire new staff. Job creation rose at the joint-steepest pace since September 2021 as pressure on capacity softened. Hopes for further upticks in client demand following the end of COVID-19 restrictions also spurred more upbeat expectations regarding the outlook for output over the coming year.

“Meanwhile, despite cost inflation easing slightly, increases in input prices and output charges remained substantial.”