Liquidity keeps things running when timing’s off. It’s what covers the space between money coming in and bills going out. Easy to ignore when things are smooth, but critical when they’re not.

It’s a key part of financial health and liquidity. And smart business liquidity planning gives you more control when it matters most.

You’ll learn what liquidity really looks like day to day, why good sales don’t always mean stability, and how a few habits can keep you ahead of cash flow trouble.

What is Liquidity, and Why Does It Matter?

It’s not complicated. Liquidity just means you’ve got cash ready when the bills hit.

It’s not about the big payments you’re expecting or the assets you own. If the cash isn’t available now, it won’t help you cover today’s bills.

A lot of businesses mix up liquidity with profitability. You might be making a profit overall, but if cash isn’t flowing in when you need it, you can still get stuck.

That’s why financial health and liquidity need to work together. One keeps you growing. The other keeps you open.

Key Reasons Liquidity is Essential for Business Survival

Think of liquidity as your business’s cushion. It lets you move, react, and stay calm under pressure.

- Handle the unexpected. Things break. Clients pay late. Cash gives you breathing room.

- Stay dependable. Pay your team and vendors on time, and they’ll keep showing up for you.

- Say yes to good stuff. A new hire, a discount, or a surprise project is easier to grab when you have the cash ready.

- Look better to lenders. Having money set aside shows you’re managing things responsibly.

- Keep things moving. Rent, tools, and supplies don’t wait. Liquidity helps you cover the basics without stress.

That’s why business liquidity planning isn’t something to save for later.

Common Liquidity Challenges for Businesses

Liquidity problems show up in nearly every business at some point, sometimes slowly, sometimes all at once. Here are some common trouble spots:

- Late customer payments: You’ve done the work, but the cash hasn’t arrived. That delay can squeeze your finances fast.

- Slow-moving inventory: Products that don’t sell tie up money you could use elsewhere.

- Too much riding on one client. If they’re late in paying, it can mess with your whole schedule.

- Seasonal ups and downs. When business slows down, you’ll feel it fast if you haven’t planned ahead.

- Not tracking cash. If you’re not checking regularly, issues can sneak up.

- Loan payments. Helpful at first, but they can quietly drain your cash.

Practical Tips for Improving Liquidity

You don’t need to turn your whole business upside down. Just a few small tweaks can give you way more control over your cash.

- Send invoices quickly. The sooner they’re out, the sooner you get paid.

- Make it easy to pay. Use online tools that take the hassle out of payments.

- Check in with your vendors. A simple ask could land you more flexible terms.

- Keep inventory moving. If something’s just sitting there, your money’s stuck too.

- Trim the extras. Cut tools or subscriptions you don’t really use.

- Look ahead every week. A quick look at what’s coming and going can save you a lot of stress later.

- Try a tool like Cash Flow Frog. It connects to your system and shows you where you stand without the guesswork.

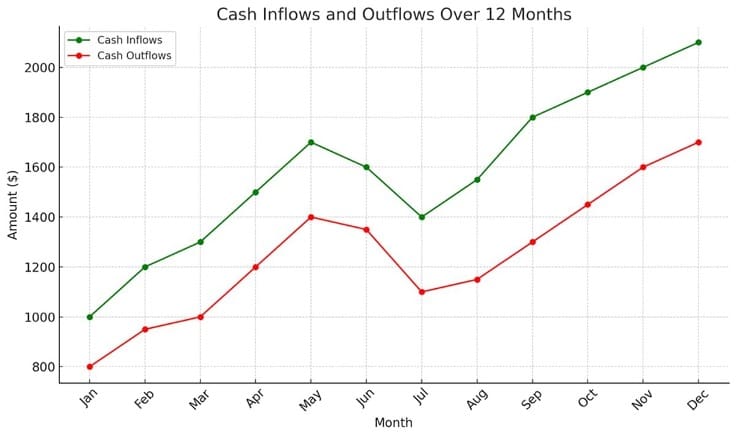

Source: Cash Flow Frog

The Role of Liquidity Planning

Keeping up with your cash is one thing. Planning ahead gives you the real peace of mind.

Start by picking a cushion that feels right. Maybe it’s one month of expenses, maybe two. Enough to keep things calm if something unexpected comes up.

Watch a few basics. Can your cash cover what’s due soon? How long could you stay afloat with what’s in the bank? Simple checks like these go a long way.

It also helps to think through a few “what ifs.” What if sales slow down? What if a big payment’s late? Having a plan makes it easier to respond, not react.

Check in on your cash every so often. Future you will be glad you did.

In Conclusion

Cash is what keeps your business steady.

You can have strong revenue and still feel stretched if your cash flow isn’t managed well. That’s why stability and planning go hand in hand. One builds the future. The other keeps you operational today.

Start with small steps. Get a clearer view of your cash. Build habits that support your stability. And keep a system in place that makes liquidity easier to manage over time.

Have advice on staying liquid? Share it below; we’d love to hear it.