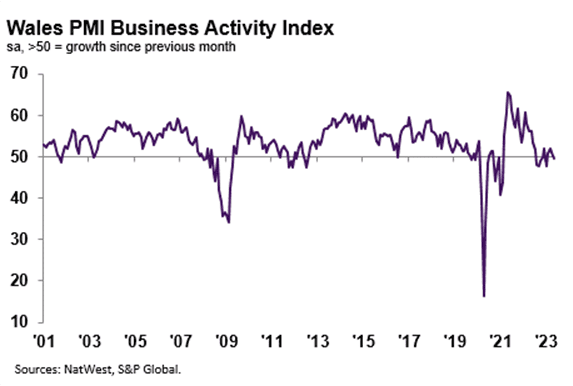

The headline NatWest Wales Business Activity Index – a seasonally adjusted index that measures the month-on-month change in the combined output of the region’s manufacturing and service sectors – registered 49.4 in May, down from 51.1 in April. The latest data signalled a renewed contraction in output, bringing to an end a three-month sequence of expansion. Of the 12 monitored UK areas, Welsh firms were alone in registering lower business activity. The decrease was only marginal overall, however. Companies noted that the fall was due to a slower rise in new orders.

Welsh private sector firms recorded a third successive monthly expansion in new business during May. The upturn in new orders was linked to sustained increases in client demand and new customer acquisitions. That said, the pace of growth was only marginal overall and the slowest in the aforementioned sequence of expansion.

The rate of growth was also much weaker than the UK trend which indicated a solid rise in new business.

May data signalled further strong positive sentiment regarding the outlook for output over the coming 12 months at Welsh firms. Optimism reportedly stemmed from planned investment in expanding capacity and developing new products, alongside hopes of greater client demand.

The overall level of confidence dipped to a three-month low. At the sub-sector level, manufacturing firms remained much more upbeat compared to their service sector counterparts.

Welsh companies registered broadly unchanged employment levels midway through the second quarter, following four successive monthly contractions. Although some firms noted the non-replacement of voluntary leavers, others stated that greater demand drove hiring.

The trend among Welsh firms contrasted with that seen across the UK as a whole, where staffing numbers rose at a modest pace. Only companies in the North East recorded a decline in workforce numbers.

Welsh private sector companies recorded a further decline in the level of outstanding business in May, thereby extending the current sequence of contraction that began a year ago. The rate of depletion accelerated and was the fastest since July 2020. Anecdotal evidence suggested that softer new order growth allowed firms to work through their incomplete business.

Of the ten UK areas that registered a decrease in work-in-hand, Welsh firms saw the steepest drop.

Input prices faced by Welsh firms rose at a further marked pace in May, as the rate of inflation posted above the long-run series average. Panellists largely attributed higher cost burdens to greater wage bills. Although substantial, the pace of increase slowed to the weakest since January 2021.

A softer uptick in operating expenses reflected the wider UK trend, where the rate of cost inflation was the slowest for over two years.

Welsh businesses recorded another sharp rise in output charges midway through the second quarter. Companies often stated that higher selling prices were due to the pass-through of greater costs to clients in an effort to protect margins. Despite being faster than the series average, the rate of charge inflation softened and was the second-slowest since April 2021.

Manufacturers and service providers both registered weaker upticks in selling prices.

Gemma Casey, NatWest Ecosystem Manager for Wales, commented:

“Welsh firms signalled a return to contraction territory in May, as output fell back into decline. New orders continued to grow, albeit at only a marginal pace. Softer demand conditions stemmed from sufficient stocks at customers and subdued client confidence. Although strongly optimistic of an increase in output over the coming year, the degree of confidence slipped to a three-month low. Meanwhile, employment was broadly stagnant as capacity pressures dissipated further.

“Cost pressures remained marked, as companies noted that increased wage bills drove inflation. Rates of input price and output charge inflation eased, however, to some of the weakest for over two years amid efforts by vendors and firms to drive new sales in an increasingly challenging demand environment.”